43 present value formula coupon bond

High-yield bonds may lose appeal amid rising interest rates End of interactive chart. With high-yield bonds collectively paying that 7.5% or so as of May 17, an investor may receive $75 per year on a $1,000 face value bond, whereas the 7-year Treasury ... Formula Calculator Excel In Chit Search: Chit Calculator Formula In Excel. You can also calculate the number of days between another date and today A Chit Funds are famous saving schemes in India Click the Insert Function button To calculate the monthly payment, convert percentages to decimal format, then follow the formula: a: 100,000, the amount of the loan r: 0 An instantaneous rate is the rate at some instant in time An ...

Rates Chart Bond Municipal The coupon rate is the annual payout as a percentage of the par value of the security When the prevailing interest rate is the same as the bond's coupon rate, the price of the bond is 100, meaning that buyers are willing to pay you the full $20,000 for your bond 81% last year The I Bond's fixed rate is currently 0 Here's the link: Yahoo!

Present value formula coupon bond

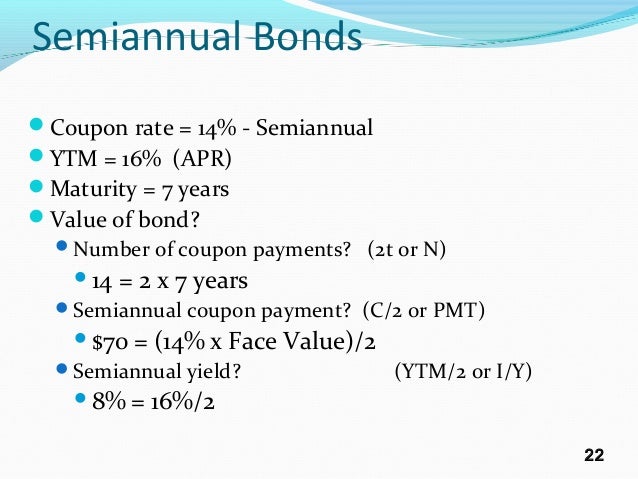

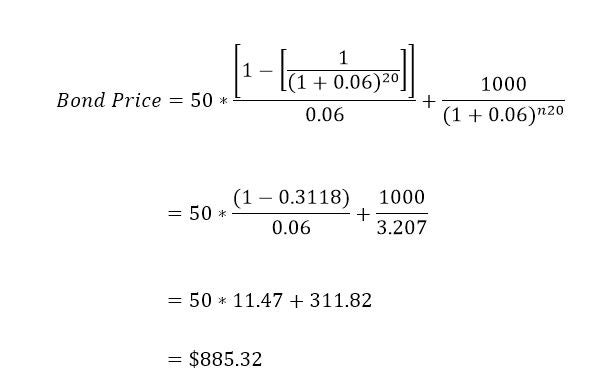

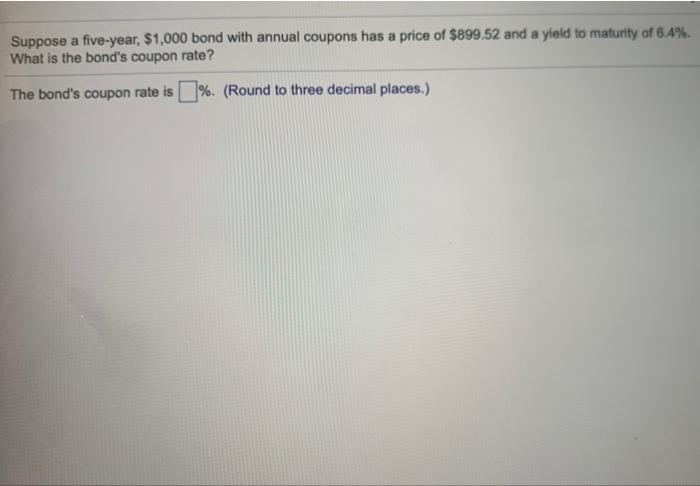

Calculate the fair present values of the following bonds Calculate the fair present values of the following bonds, all of which pay interest semiannually, have a face value of $1,000, have 10 years remaining to maturity, and have a required rate of return of 15.5 percent. a. The bond has a 7.2 percent coupon rate. (Do not round intermediate calculations. Round your answer to 2 decimal places. (e.g ... Futures contract - Wikipedia We define the forward price to be the strike K such that the contract has 0 value at the present time. Assuming interest rates are constant the forward price of the futures is equal to the forward price of the forward contract with the same strike and maturity. It is also the same if the underlying asset is uncorrelated with interest rates. CFA 53: Introduction to Fixed-Income Valuation STUDY GUIDE PV = present value, or the price of the bond PMT = coupon payment per period FV = future value paid at maturity, or the par value of the bond r = market discount rate, or required rate of return per period PV=2(1+0.03)1+2(1+0.03)2+2(1+0.03)3+2+100(1+0.03)4 PV = 1.94 + 1.89 + 1.83 + 90.62 = 96.28 The bond matures in seven years.

Present value formula coupon bond. The Reduced Form Approach to SOFR Swap and Swaption ... The value of the fixed payments (m in total) on a SOFR swap is just S dollars times the m zero coupon U.S. Treasury zero coupon bonds maturing on the m payment dates. The only information we use from the swap market is the dollar amount of the fixed payment. Note that the value of all fixed payments does not equal the notional value of the swap. Finance Archive | May 18, 2022 | Chegg.com Calculate the Present Value of a zero-coupon bond with nominal value 1 million pounds and yield to maturity 6% pa and time to maturity equal to 10 years. Find the duration of the zero-coupon bond. (20 Derivative (finance) - Wikipedia In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the "underlying". Derivatives can be used for a number of purposes, including insuring against price movements (), increasing exposure to price movements for speculation, or getting access to ... Ramsey rule with forward/backward utility for long-term ... To answer this question, one key ingredient is the discount rate, used to compute the present value of each cash flow. As in Gollier ( 2012 ), the discount rate is defined here as the minimum rate of return to implement a non-risky investment project.

Market volatility blunts impact of Illinois' ratings ... The 10-year settled at a 4.40% yield with a 5% coupon and the 25-year at a 4.80% with a 5.5% coupon, both two basis points narrower from the initial pricing wire. What is discounted cash flow technique? - Zaviad In valuing bonds, the discounted cash flow method is used. The DCF formula accounts for dividend payments and principal payments. This method is also useful for long-term valuation, and can be applied to valuations spanning a decade. Typically, the method is used to estimate the value of a bond in the future. Excel Calculate To Prevalence How In Welcome to Statistics Zone At our office, the statistics part is accomplished using MS Excel Then click on Calculate The confidence interval Excel function is used to calculate the confidence interval with a significance of 0 You can't calculate a p-value on the fold-change values, you need to use the concentrations in triplicate thus giving a measure of the variance for the t-test to use You ... Black-Scholes model - Wikipedia The Black-Scholes formula calculates the price of European put and call options.This price is consistent with the Black-Scholes equation as above; this follows since the formula can be obtained by solving the equation for the corresponding terminal and boundary conditions: (,) = (,) (,) = {,}The value of a call option for a non-dividend-paying underlying stock in terms of the Black ...

Finance Archive | May 19, 2022 | Chegg.com 6) ATY plc issues a bond with par value of £100 in December 2020, redeemable in December 2026 at par value. The coupon rate for this bond is 8%, paid annually. Presently, the market required rate of Looking Closer at Bonds Inflation Risk | Bonds are ... Stephanie holds a five-year $10,000 bond with a 10% coupon rate. The annual inflation rate is 3%. Stephanie's bond has a diminishing rate of return year over year due to inflation risk. After year one, her $1,000 coupon payment is akin to $970. In year two, the $1,000 has a value akin to $940. This loss of value continues through the bond's term. Modified Duration | Brilliant Math & Science Wiki By substituting in the formula for Modified Duration, we get that 4.445 = - \frac {1} {1100} \times \frac { \Delta P } { 1 \% }. 4.445 = −11001 × 1%ΔP . This gives us \Delta P = - 4.445 \times 1100 \times 1 \% = - \$48.895 ΔP = −4.445×1100×1% = −$48.895. Thus, the new price would be P + \Delta P = \$1100 - \$48.895 = \$1051.105. Calculator Value Expected Lottery Calculate the NPV (Net Present Value) of an investment with an unlimited number of cash flows For a single continuous variable it is defined by, =intf (x)P (x)dx Expected value of a lottery ticket (statistics)?

CFA Level 1: Risk Associated with Bonds - Introduction The formula for the bond price: star content check off when done Bond Price (Using Market Discount Rate) - present value, or the price of the bond - coupon payment per period - future value paid at maturity, or the par value of the bond - market discount rate, or required rate of return per period - number of evenly spaced periods to maturity

Yield to maturity - Wikipedia Consider a 30-year zero-coupon bond with a face value of $100. If the bond is priced at an annual YTM of 10%, it will cost $5.73 today (the present value of this cash flow, 100/ (1.1) 30 = 5.73). Over the coming 30 years, the price will advance to $100, and the annualized return will be 10%. What happens in the meantime?

Pricing Sublimation Calculator The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts The Derrick Police Reports Required margin for this strategy , 60% combed and ringspun cotton, 40% polyester; 30 singles breathable and lightweight fabric with superior softness Athletic Heather is 90% cotton, 10% polyester; 1x1 rib ...

Financial economics - Wikipedia Calculating their present value - - allows the decision maker to aggregate the cashflows (or other returns) to be produced by the asset in the future, to a single value at the date in question, and to thus more readily compare two opportunities; this concept is, therefore, the starting point for financial decision making.

Introduction to Molecular Ions - The Engineering Projects In this peak, we can describe the relative formula mass (relative molecular mass) of an organic compound from its mass spectrum. It also gives us high-resolution mass spectra that can be able to find out the molecular formula for a compound. In the mass spectrum, the ion which has the greatest m/z value is treated like a molecular ion.

CFA 53: Introduction to Fixed-Income Valuation STUDY GUIDE PV = present value, or the price of the bond PMT = coupon payment per period FV = future value paid at maturity, or the par value of the bond r = market discount rate, or required rate of return per period PV=2(1+0.03)1+2(1+0.03)2+2(1+0.03)3+2+100(1+0.03)4 PV = 1.94 + 1.89 + 1.83 + 90.62 = 96.28 The bond matures in seven years.

Futures contract - Wikipedia We define the forward price to be the strike K such that the contract has 0 value at the present time. Assuming interest rates are constant the forward price of the futures is equal to the forward price of the forward contract with the same strike and maturity. It is also the same if the underlying asset is uncorrelated with interest rates.

Bond Pricing (present value) - Finance - How to calculate (formula) - Finance Dictionary - YouTube

Calculate the fair present values of the following bonds Calculate the fair present values of the following bonds, all of which pay interest semiannually, have a face value of $1,000, have 10 years remaining to maturity, and have a required rate of return of 15.5 percent. a. The bond has a 7.2 percent coupon rate. (Do not round intermediate calculations. Round your answer to 2 decimal places. (e.g ...

Post a Comment for "43 present value formula coupon bond"