38 a 10 year bond with a 9 annual coupon

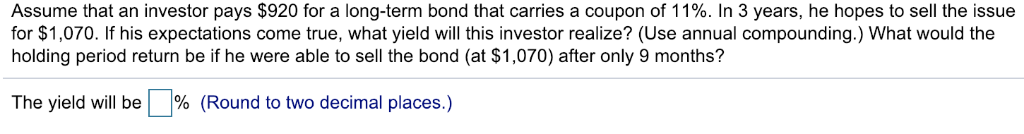

Chapter 7 Homework Finance Flashcards - Quizlet Bond A has a 9% annual coupon, while Bond B has a 7% annual coupon. Both bonds have the same maturity, a face value of $1,000, an 8% yield to maturity, and are noncallable. Which of the following statements is CORRECT? a. Bond A's capital gains yield is greater than Bond B's capital gains yield. b. Solved What is the yield to maturity on a 10-year, 9 percent - Chegg Expert Answer 100% (31 ratings) According to the given information, Years to maturity = 10 Annual coupon rate = 9% Annual coupon payment = Face value of the bond * Annual coupon rate = $1000 * 9% = $90 Face value of the bond = $1000 Present value of the bond = $887 CAlculating the … View the full answer Previous question Next question

A 10-year bond with a 9% annual coupon has a yield to maturity… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more

A 10 year bond with a 9 annual coupon

FINN 3226 CH. 4 Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. A 10-year bond paying 8% annual coupons pays $1000 at maturity ... - Quora Answer (1 of 3): We can use the formula for present value of annuity to calculate this. The formula is: Here P is the amount annually paid i.e. 80 (assuming nominal value of $1000), r is the required rate of return i.e. 7%(not coupon rate of 8%) and n is 10 years. Also, the above formula consid... [Solved] A 10-year bond with a 9% annual coupon has a yield to maturity ... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

A 10 year bond with a 9 annual coupon. Solved 1) A 10-year bond with a 9% annual coupon has a yield | Chegg.com Question: 1) A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling at a premium to par value. b. The bond is selling at a discount. c. The bond is selling below its par value. d. The bond will earn a rate of return greater than 8%. This problem has been solved! A 10-year corporate bond has an annual coupon of 9%. The bon A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000)…. Show more A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is CORRECT? a. The bond's expected capital gains yield is zero. {C} b. Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates ... A 10 year corporate bond has an annual coupon payment of 9 percent The ... A 10-year corporate bond has an annual coupon payment of 9 percent. The bond is currently selling at par ($1,000). Which of the followingstatements is most correct? a. The bond's yield to maturity is 9 percent. b. The bond's current yield is 9 percent. c. If the bond's yield to maturity remains constant, the bond's price will remain at par. d.

V a 10 year bond with a 9 percent semiannual coupon v A 10 year bond with a 9 percent semiannual coupon is currently selling at par from FIN FIN-3403 at University of North Florida. Study Resources. Main Menu; ... V a 10 year bond with a 9 percent semiannual coupon. School University of North Florida; Course Title FIN FIN-3403; Type. Notes. Answered: A 10-year bond with a 9% annual coupon… | bartleby Transcribed Image Text: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%. A 10 year bond with a 9 annual coupon has a yield to - Course Hero A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * 1/1 a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value. c. The bond is selling at a discount. d. Question 12 a 10 year bond with a 9 annual coupon has Correct Answer: If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. 2 out of 2 points 2 out of 2 points Question 13 Bond A has a 9% annual coupon while Bond B has a 6% annual coupon.

Answered: What is the price of the following… | bartleby Solution for What is the price of the following semi-annual bond? face value: maturity: years coupon rate: discount rate: $1,000 10 8% 9%. Skip to main content. close. Start your trial now! First week only $4.99! arrow ... A P1,000 par value, 12-year annual bond carries a coupon rate of 7%. If the current yield of this… Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84 What Is Coupon Rate and How Do You Calculate It? - SmartAsset For example, ABC Corporation could issue a 10-year, zero-coupon bond with a par value of $1,000. They might then sell it for $900. The purchaser would hold the note for 10 years and at the date of maturity would redeem it for $1,000, making $100 in profit. Bottom Line. A bond coupon rate can be a nice annual payout for a bond holder. Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg Question: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value This problem has been solved!

chapter 7 practice quiz Flashcards | Quizlet An investor is considering buying one of two 10-year, $1,000 face value bonds: Bond A has a 7%. annual coupon, while Bond B has a 9% annual coupon. Both bonds have a yield to maturity of 8%, which is expected to remain constant for the next 10 years. Which of the following statements is.

Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of...

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its

Solved A 10-year bond with a 9% annual coupon has a yield to | Chegg.com A 10-year bond with a 9% annual coupon has a yield to maturity of 8% which statement about this bond is correct? O a. The bond is selling at a premium to its par value. O b. The bond is selling at a discount to its par value. O c. The bond is selling below its par value O d. The bond is price to sell at its par value. Save & Continue

FM Exam Study Flashcards | Quizlet Mary purchased a 10 year par value bond with an annual nominal coupon rate of 4% payable semiannually at a price of 1021.50. The bond can be called at 100 over the par value of 1100 on any coupon date starting at the end of year 5 and ending 6 months prior to maturity.

Bond concepts 14 A 10 year bond with a 9 annual coupon has a yield to ... Bond concepts 14. A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling at a discount. b. The bond's current yield is greater than 9%. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

Finance Chapter 8 Flashcards | Quizlet Coupon rate = C = 8.25% Annual coupon = $1,000 × 0.0825 = $82.50 Current market rate = i = 6.875% P=1066 The market price of a 10-year, $1,000 bond is $1,158.91. Interest on this bond is paid semiannually and the YTM is 14%. What is the bond's annual coupon rate? (Round your answer to the nearest percent.) 17%

What is the value of a 10-year, $1,000 par value bond with a 10 percent ... When you buy a bond for, say $1000, and the coupon rate is 10% for 10 years, paying you $100 per year. Where is the profit in that? You get the $1000 back at maturity. So you collect $100 of interest for 10 years and receive $1000 of principal at maturity. So you collect a total of $2000 for your $1000 investment. Arvind Pradhan

[Solved] A 10-year $1,000 par value bond has a 9% semiannual coupon and ... A 10-year $1,000 par value bond has a 9% semiannual coupon and a nominal yield to maturity of 8.8%. What is the price of the bond? Coupon A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

How to Calculate the Price of Coupon Bond? - WallStreetMojo Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd.

A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is NOT … read more Neo 14,498 satisfied customers The Carter Companys bonds mature in 10 years have a par value

[Solved] A 10-year bond with a 9% annual coupon has a yield to maturity ... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

A 10-year bond paying 8% annual coupons pays $1000 at maturity ... - Quora Answer (1 of 3): We can use the formula for present value of annuity to calculate this. The formula is: Here P is the amount annually paid i.e. 80 (assuming nominal value of $1000), r is the required rate of return i.e. 7%(not coupon rate of 8%) and n is 10 years. Also, the above formula consid...

FINN 3226 CH. 4 Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b.

Post a Comment for "38 a 10 year bond with a 9 annual coupon"