38 is yield to maturity the same as coupon rate

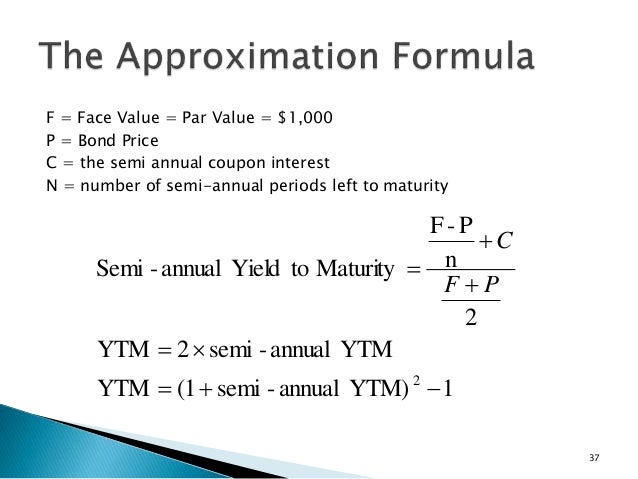

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate. The coupon rate is the annual income an investor can expect to receive while holding a particular bond. At the time it is purchased, a bond's yield to maturity ... What Is the Difference Between IRR and the Yield to Maturity? Mar 27, 2019 · A precise calculation of YTM is rather complex, as it assumes that all coupon payments are reinvested at the same rate as the current yield, and takes into account the present value of the bond.

Chapter 10 Flashcards | Quizlet Chapter 10. Term. 1 / 18. The yield to maturity on a bond is. a. Below the coupon rate when the bond sells at a discount and above the coupon rate when the bond sells at a premium. b. The interest rate that makes the present value of the payments equal to the bond price. c. Based on the assumption that all future payments received are ...

Is yield to maturity the same as coupon rate

Yield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... How to calculate yield to maturity in Excel (Free Excel Template) Sep 12, 2021 · Coupon Rate, rate = 6%; Coupons per Year, nper = 4 (quarterly) Years of Maturity = 10; Now, you went to a bond rating agency (Moody’s, S&P, Fitch, etc.) and they rated your bond as AA+. More about the bond rating. But the problem is: when you tried to sell the bond, you see that the same rated bond is selling with 7.5% YTM (yield to maturity). Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia If a bond's purchase price is equal to its par value, then the coupon rate, current yield, and yield to maturity are the same. 1 When discussing bonds, it is important to note the many different...

Is yield to maturity the same as coupon rate. Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS 1. Yield to Maturity Calculator | Calculate YTM Jul 14, 2022 · Determine the annual coupon rate and the coupon frequency; coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a ... Yield to Maturity (YTM) - Wall Street Prep The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula Coupon Rate Calculator | Bond Coupon As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond.It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.. On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond investments if you hold them ...

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date. Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate. Understanding Coupon Rate and Yield to Maturity of Bonds The resulting YTM will differ from the Coupon Rate. This is simply because interest rates change daily. To prove this point, say a month later you decide to purchase the same RTB 03-11 in the secondary market. However, Interest rates increased. From 2.375%, quoted yield increased to 2.700%. Yield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is the (theoretical) internal rate of return …

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security. ... On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like ... Solved Is the yield to maturity on a bond the same thing as - Chegg This problem has been solved! Is the yield to maturity on a bond the same thing as the required return? Is YTM the same thing as the coupon rate? Suppose today a 10 percent coupon bond sells at par. Two years from now, the required return on the same bond is 8 percent. What is the coupon rate on the bond then? Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity Calculator Inputs. Current Bond Trading Price ($) - The price the bond trades at today. Bond Face Value/Par Value ($) - The face value of the bond, also known as the par value of the bond. Years to Maturity - The numbers of years until bond maturity.; Bond YTM Calculator Outputs. Yield to Maturity (%): The converged upon solution for the yield to maturity of the …

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ...

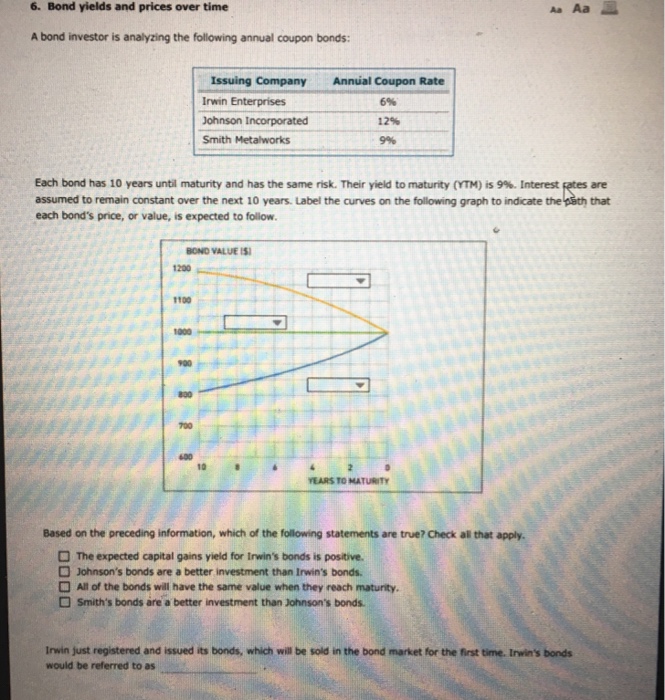

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than...

Yield to Maturity - YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until the bond...

Solved If the yield to maturity and the coupon rate are the - Chegg Finance questions and answers. If the yield to maturity and the coupon rate are the same, then the bond should sell for ______.a. a premium b. a discount c. par valueTo answer enter a, b, or c. SubmitAnswer format: Text.

Yield to Maturity (YTM) Calculator Yield to Maturity is the index for measuring the attractiveness of bonds. When the price of the bond is low the yield is high and vice versa. YTM is beneficial to the bond buyer because a rising yield would decrease the bond price hence the same amount of interest is paid but for less money. Where the coupon payment refers to the total interest ...

FIN 221 Exam 1 Flashcards | Quizlet rate, the bond's current yield must also exceed its coupon rate. b. If a bond's yield to maturity exceeds its coupon rate, the bond's price must be less than its maturity value. c. If two bonds have the same maturity, the same yield to maturity, and the same level of risk, the bonds should sell for the same price regardless of the bond's coupon ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Given the following zero-coupon yields, compare the yield to maturity ... From the information provided, the yield to maturity of the three-year zero-coupon bond is 4.50%. Also, because the yields match those in Table 6.7, we already calculated the yield to maturity for the 10% coupon bond as 4.44%. To compute the yield for the 4% coupon bond, we first need to calculate its price, which we can do using Eq. 6.4.

Post a Comment for "38 is yield to maturity the same as coupon rate"