43 coupon rate of bond calculator

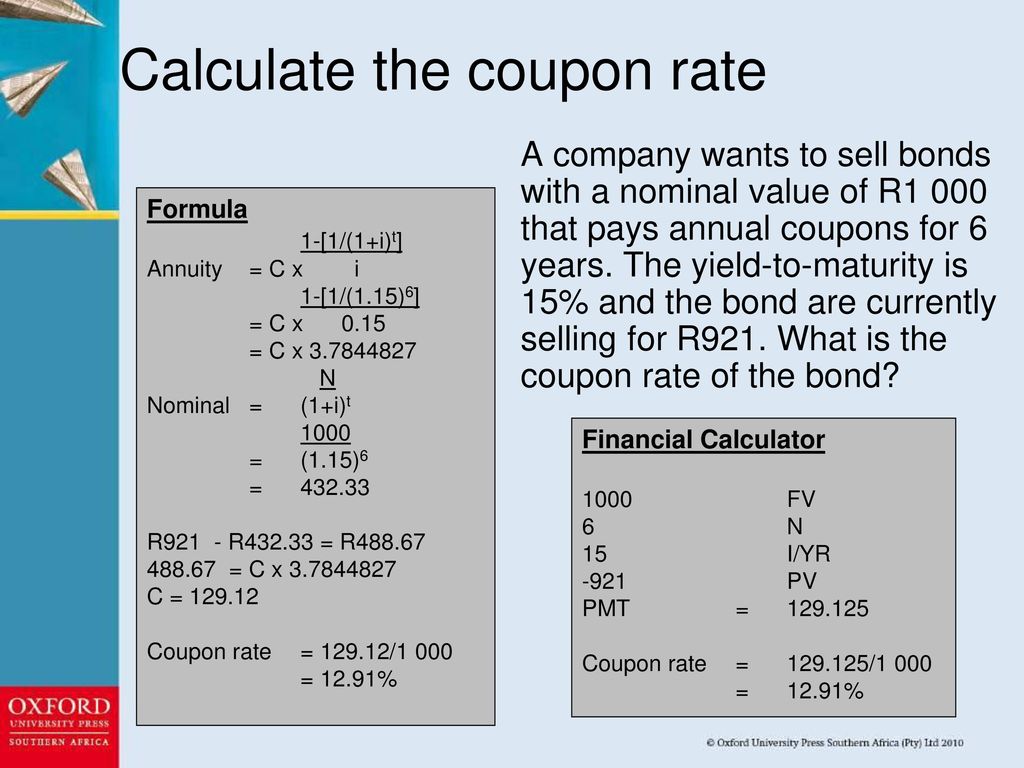

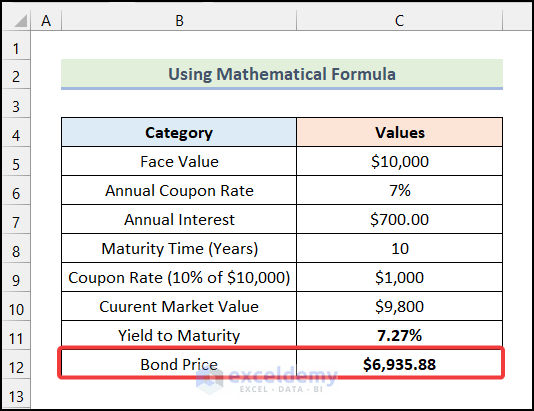

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... Bond Present Value Calculator Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. If the market rate is greater than the coupon rate, the present value is less than the face value. If it is less than the coupon rate, the present value is greater than ...

› loanLoan Calculator Users should note that the calculator above runs calculations for zero-coupon bonds. After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors. While this does not change the bond's value at maturity, a bond's market price can still vary during its lifetime. Loan Basics for Borrowers

Coupon rate of bond calculator

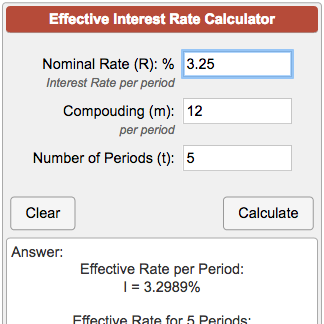

› bond-valueBond Value Calculator: What It Should Be Trading At | Shows Work! Enter the coupon rate of the bond (only numeric characters 0-9 and a decimal point, no percent sign). The coupon rate is the annual interest the bond pays. If a bond with a par value of $1,000 is paying you $80 per year, then the coupon rate would be 8% (80 ÷ 1000 = .08, or 8%). calculator.academy › zero-coupon-bond-calculatorZero Coupon Bond Calculator - Calculator Academy Jan 05, 2022 · where ZCBV is the zero-coupon bond value; F is the face value of the bond; r is the yield/rate; t is the time to maturity; Zero Coupon Bond Definition. A zero-coupon bond is a security that does not pay interest but trades at a discount and renders a profit at maturity when the bond is redeemed for its face value. Zero Coupon Bond Example › bond-calculatorBond Pricer & YTM Calculator – Calculate Bond Prices and ... YTM is often quoted in terms of an annual rate and may differ from the bond’s coupon rate. It assumes that coupon and principal payments are made on time. Further, it does not consider taxes paid by the investor or brokerage costs associated with the purchase.

Coupon rate of bond calculator. Bond Duration Calculator – Macaulay and Modified Duration On this page is a bond duration calculator.It will compute the mean bond duration measured in years (the Macaulay duration), and the bond's price sensitivity to interest rate changes (the modified duration).. You can input either the market yield or yield to maturity, or the bond's price, and the tool will compute the associated durations.. Macaulay and Modified Bond Duration … Bond Duration Calculator - Exploring Finance Example of using the Bond Duration Calculator. Suppose that you have a bond, where the: Number of years to maturity is 2; Yield is 8% ; Bond face value is 1000 ; Annual coupon rate is 6% ; Payments are semiannually (1) What is the bond’s Macaulay Duration? (2) What is the bond’s Modified Duration? You can easily calculate the bond duration ... dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price ... P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

› bond-calculatorBond Pricer & YTM Calculator – Calculate Bond Prices and ... YTM is often quoted in terms of an annual rate and may differ from the bond’s coupon rate. It assumes that coupon and principal payments are made on time. Further, it does not consider taxes paid by the investor or brokerage costs associated with the purchase. calculator.academy › zero-coupon-bond-calculatorZero Coupon Bond Calculator - Calculator Academy Jan 05, 2022 · where ZCBV is the zero-coupon bond value; F is the face value of the bond; r is the yield/rate; t is the time to maturity; Zero Coupon Bond Definition. A zero-coupon bond is a security that does not pay interest but trades at a discount and renders a profit at maturity when the bond is redeemed for its face value. Zero Coupon Bond Example › bond-valueBond Value Calculator: What It Should Be Trading At | Shows Work! Enter the coupon rate of the bond (only numeric characters 0-9 and a decimal point, no percent sign). The coupon rate is the annual interest the bond pays. If a bond with a par value of $1,000 is paying you $80 per year, then the coupon rate would be 8% (80 ÷ 1000 = .08, or 8%).

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "43 coupon rate of bond calculator"