43 perpetual zero coupon bond

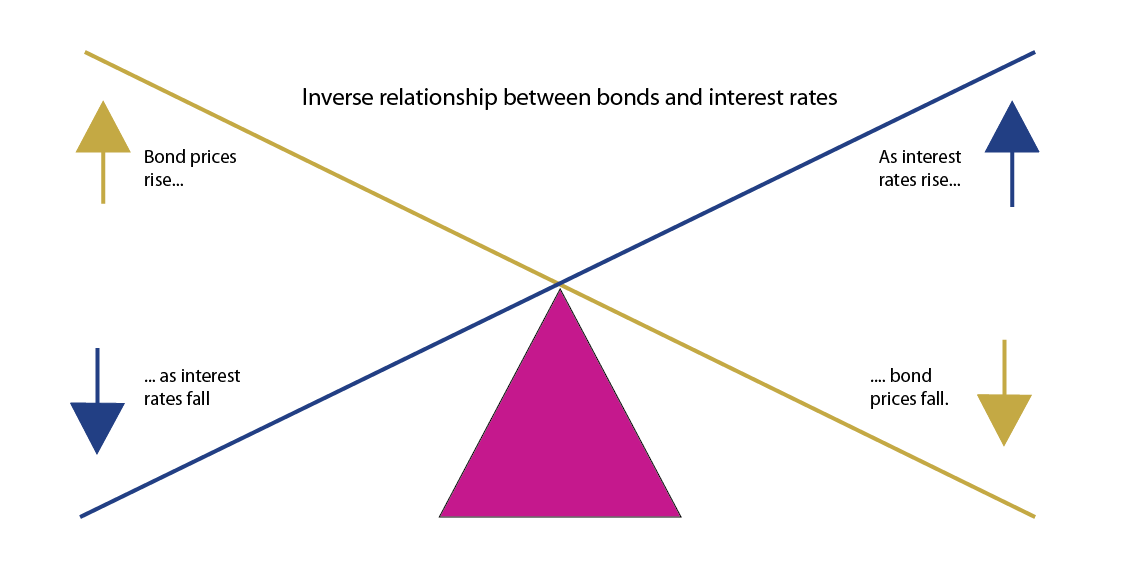

Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

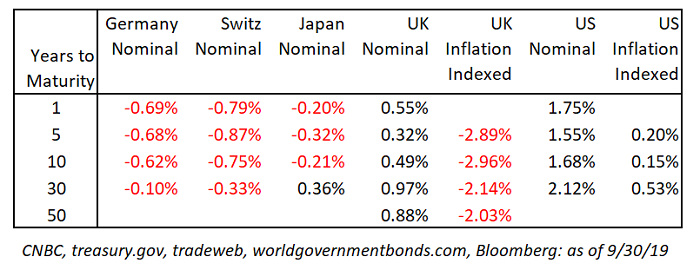

Bond market - Wikipedia Bond trading prices and volumes are reported on Financial Industry Regulatory Authority's (FINRA) Trade Reporting and Compliance Engine, or TRACE. An important part of the bond market is the government bond market, because of its size and liquidity. Government bonds are often used to compare other bonds to measure credit risk.

Perpetual zero coupon bond

Seriously, Money Is Not A Zero Coupon Perpetual - Bond Economics Jul 24, 2016 ... A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit ... Course Help Online - Have your academic paper written by a ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

Perpetual zero coupon bond. Zero-coupon perpetual bonds: this April Fool is no joke | MoneyWeek Aug 19, 2016 ... The difference between a central bank owning zero-coupon perpetuals and conventional bonds is that the former cannot be sold to withdraw excess ... FWDGRP ZERO Perpetual Corp (USD) - Bondsupermart Bond Information FWD Group Limited operates as an insurance broker. ... U.S.$164,000,000 Zero Coupon Subordinated Perpetual Capital Securities to be ... Chancellor: Zero-coupon bonds are not a joke - Reuters Aug 26, 2016 ... The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. Impossible Finance — The Zero Coupon Perpetual Bond One special type of bond is the “Zero coupon bond” which does not pay interest but is issued at a discount to the face value. It is the face value that is paid ...

Perpetual Bonds - Overview, Issuers, Advantages, Disadvantages They pay interest to investors in the form of coupon payments, just as with most bonds, but the bond's principal amount does not come with a set ... BOLI – The “Zero Coupon Perpetual Bond” BOLI is a bond — a “zero coupon perpetual bond.” What's fascinating about this bond is that neither ABC Insurance Company nor. FWDGRP 8.045% Perpetual Corp (USD) - Bondsupermart Bond Information FWD Group Limited operates as an insurance company. ... U.S.$500,000,000 Zero Coupon Subordinated Perpetual Capital Securities. Warrant (finance) - Wikipedia Inflation-indexed bond; Perpetual bond; Zero-coupon bond; ... Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce ...

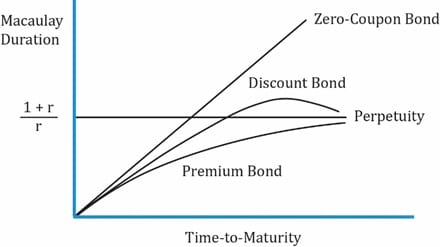

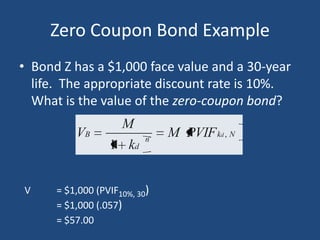

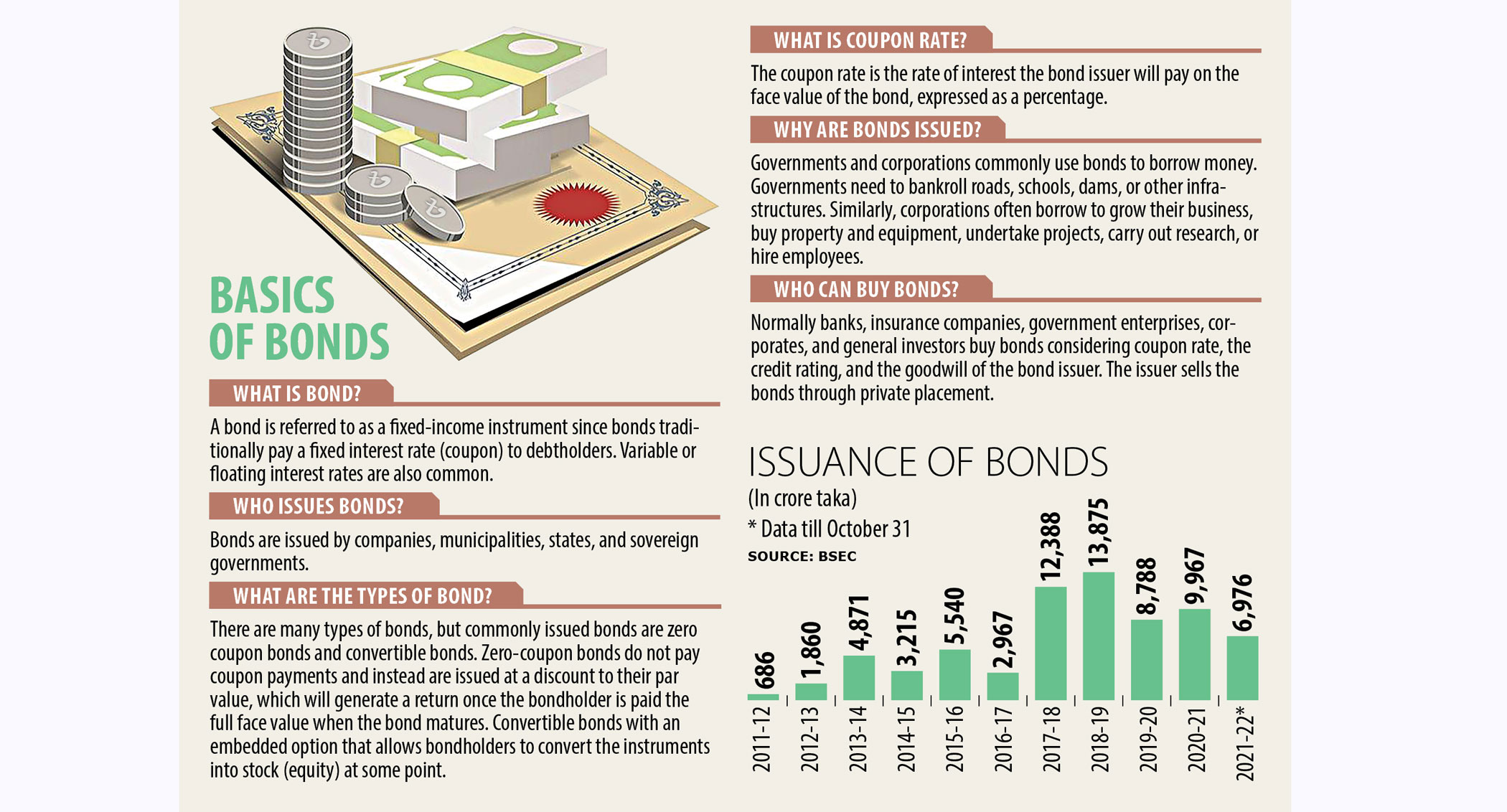

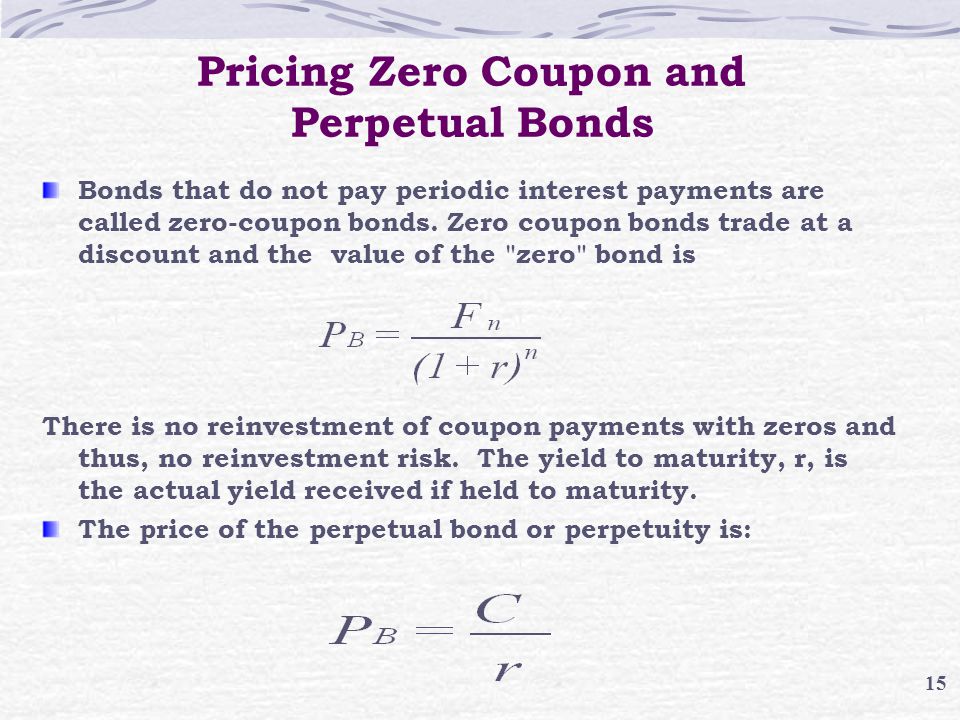

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Bond duration - Wikipedia The zero-coupon bond will have the highest sensitivity, changing at a rate of 9.76% per 100bp change in yield. This means that if yields go up from 5% to 5.01% (a rise of 1bp) the price should fall by roughly 0.0976% or a change in price from $61.0271 per $100 notional to roughly $60.968. What is the fair price of a perpetual zero-coupon bond? - Quora Feb 27, 2020 ... Normal economic reasoning says a security that never pays any interest and never repays principal has zero value, since it never pays anything. But then someone ... Course Help Online - Have your academic paper written by a ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit ...

Seriously, Money Is Not A Zero Coupon Perpetual - Bond Economics Jul 24, 2016 ... A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity ...

Post a Comment for "43 perpetual zero coupon bond"