41 present value of coupon bond

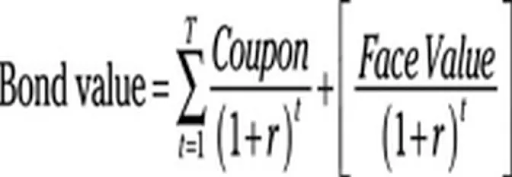

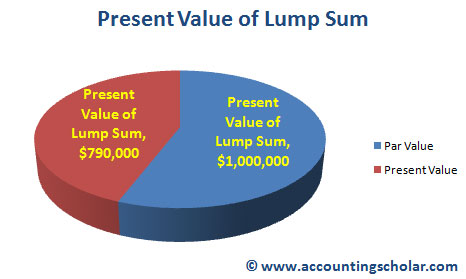

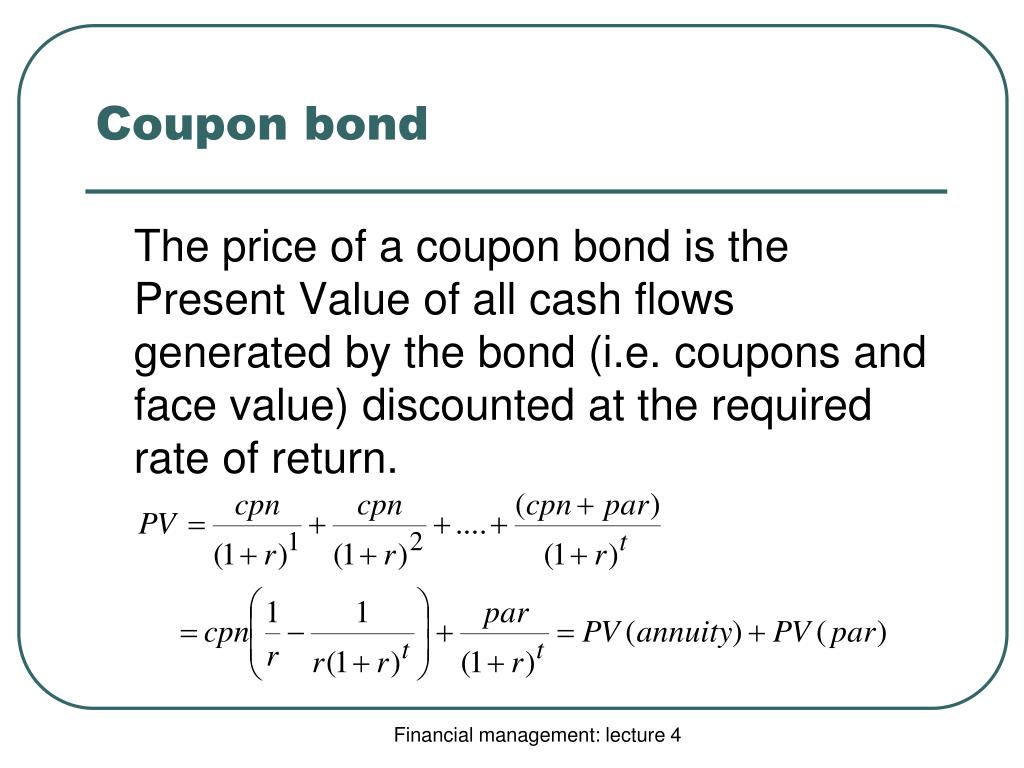

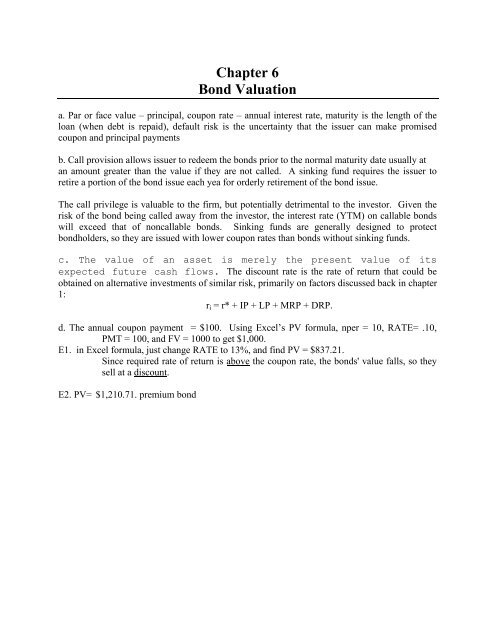

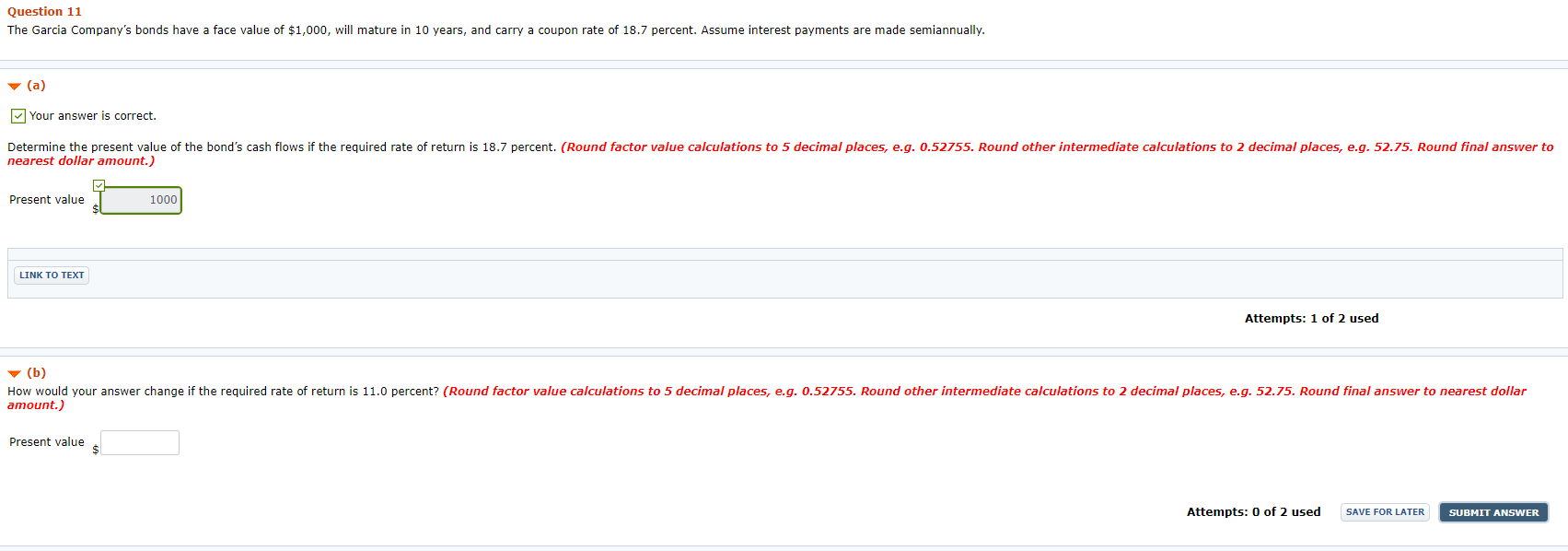

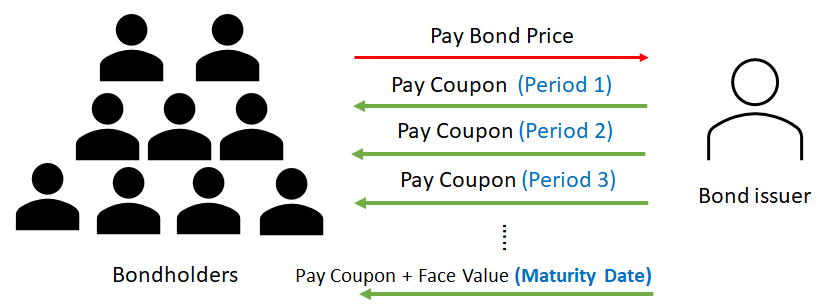

› present-value-of-annuity-formulaPresent Value of Annuity Formula | Calculator (With Excel ... Present Value of Ordinary Annuity = $1,000 * [1 – (1 + 5%/4)-6*4] / (5%/4) Present Value of Ordinary Annuity = $20,624 Therefore, the present value of the cash inflow to be received by David is $20,882 and $20,624 in case the payments are received at the start or at the end of each quarter respectively. en.wikipedia.org › wiki › Present_valuePresent value - Wikipedia A bondholder will receive coupon payments semiannually (unless otherwise specified) in the amount of , until the bond matures, at which point the bondholder will receive the final coupon payment and the face value of a bond, (+). The present value of a bond is the purchase price.

› news-and-insightsNews and Insights | Nasdaq Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

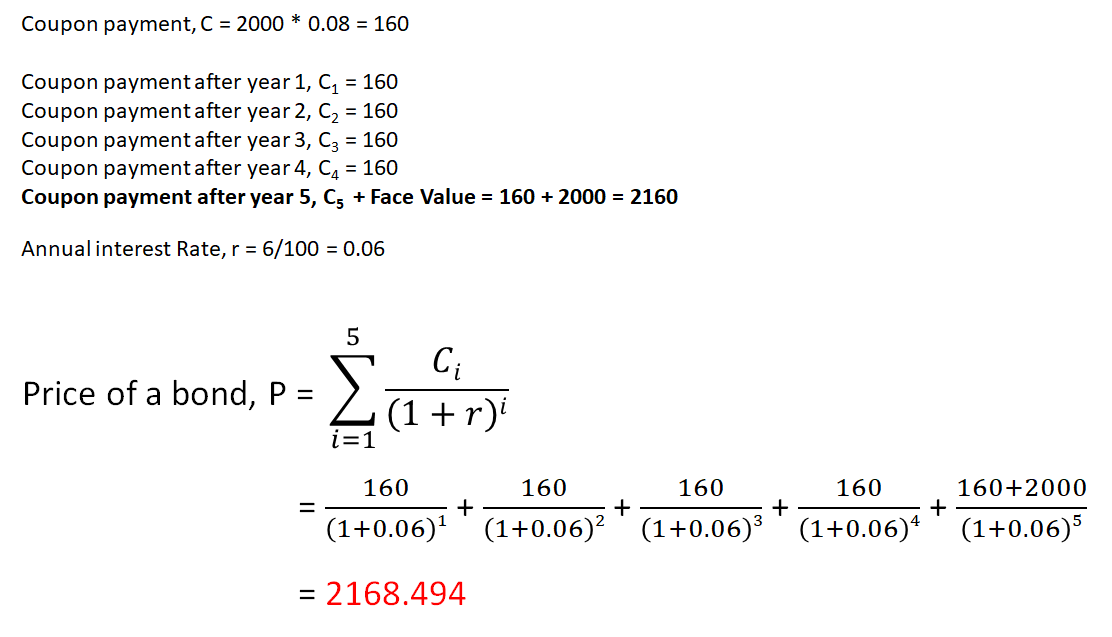

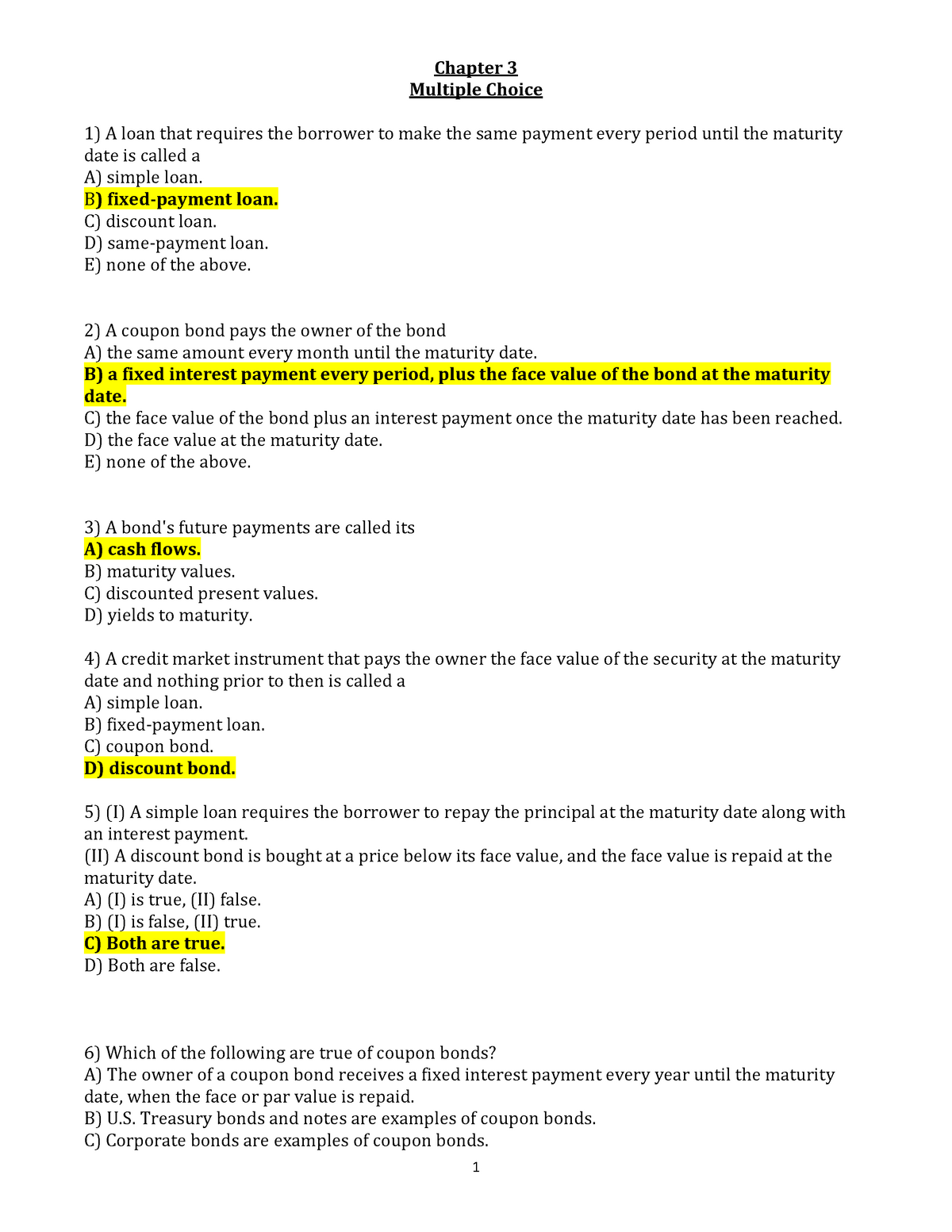

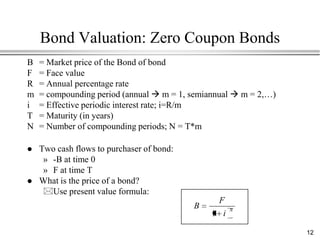

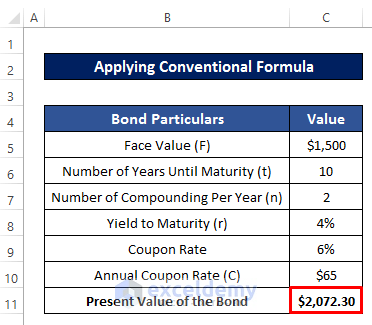

Present value of coupon bond

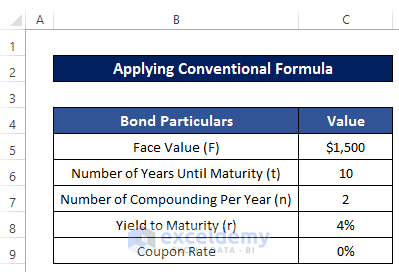

› calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts. Plus dirty & clean bond price formulas. › bond-valueBond Value Calculator: What It Should Be Trading At | Shows Work! How To Calculate The Value of a Bond. Since the value of a bond is equal to the sum of the present values of the par value and all of the coupon payments, we can use the Present Value of An Ordinary Annuity Formula to find the value of a bond. Bond Valuation Example. Suppose XYZXYZ's new bonds? In other words, what should the price be?

Present value of coupon bond. › present-value-formulaPresent Value Formula | Calculator (Examples with Excel Template) Present Value= $961.54 + $924.56 + $889.00 + $854.80; Present Value = Therefore, the present-day value of John’s lottery winning is . Explanation. The formula for the present value can be derived by using the following steps: Step 1: Firstly, figure out the future cash flow which is denoted by CF. Step 2: Next, decide the discounting rate ... › bond-valueBond Value Calculator: What It Should Be Trading At | Shows Work! How To Calculate The Value of a Bond. Since the value of a bond is equal to the sum of the present values of the par value and all of the coupon payments, we can use the Present Value of An Ordinary Annuity Formula to find the value of a bond. Bond Valuation Example. Suppose XYZXYZ's new bonds? In other words, what should the price be? dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts. Plus dirty & clean bond price formulas. › calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Post a Comment for "41 present value of coupon bond"